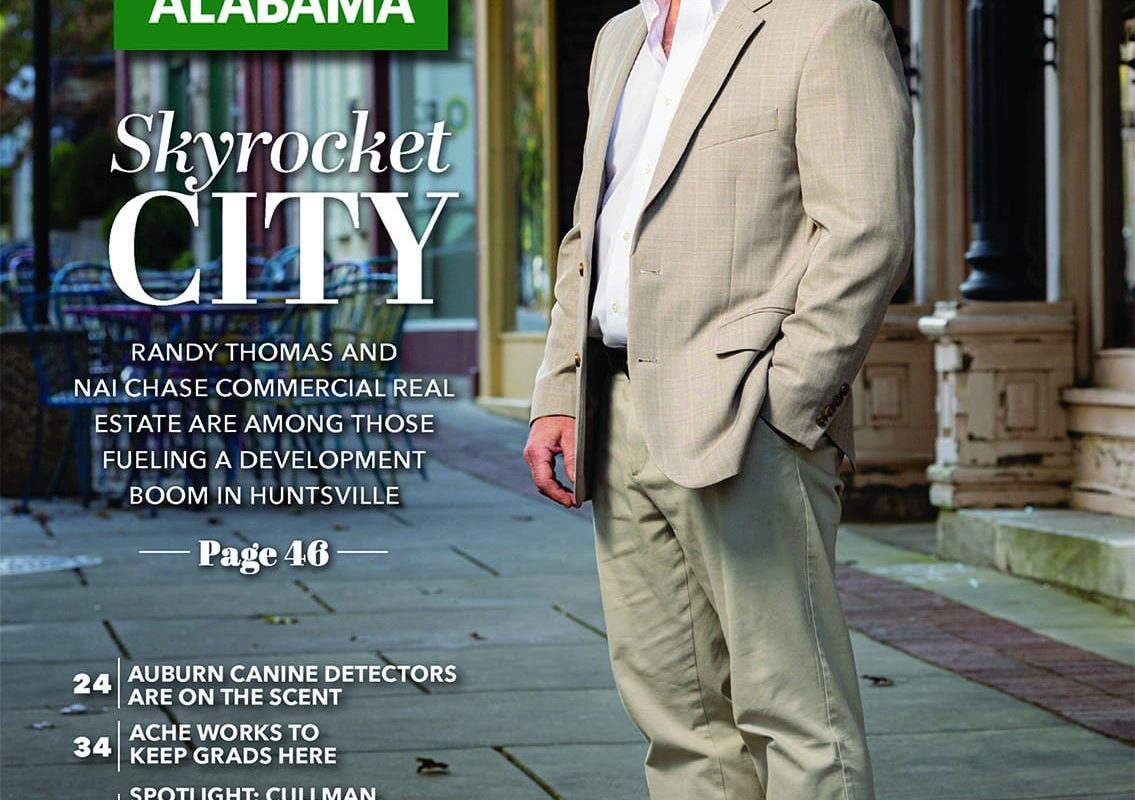

Huntsville, Alabama - November 1, 2022 Huntsville is Booming Business_ Alabama_NOV22_ Huntsville_is_Booming ABOUT NAI CHASE…

Why Do People Invest in Real Estate?

Real estate investments have long been favored because, unlike many other investment assets, they are more than a simple piece of paper. One can touch and see the asset.

Many practitioners just getting into the business do not fully grasp the concept of investing in real estate. Simply put, real estate is an investment vehicle, much like stocks, bonds, IRAs, and other core investments. Real estate investment offers a variety of facets that cause pension funds, equity funds, and persons of high net worth to use real estate to diversify their portfolios. While there are many areas and specialties within real estate (retail, office, industrial, multi family, storage, etc.), each area offers value as an investment. At their core, investments simply use money to make money – and real estate investments do this very well.

Why Real Estate?

Real estate investments have long been favored because, unlike many other investment assets, they are more than a simple piece of paper. One can touch and see the asset. It has a physical location and a large part of it will always exist (the land). Real estate goes all the way back to the beginning of time as being a highly-valued asset. Real estate can also pass from generation to generation, so there is little time value loss. Real estate will always exist.

Return, Return, Return

The key to investing in real estate is the return one gets from the investment. The return is the net dollars that the real estate produces. This return can come from cash flow, but it can also come from appreciation. For example, imagine a piece of vacant land. This piece of land does not produce cash flow returns, but the land can produce appreciation over time. The cash return on vacant land comes only from the sale of the land, but the asset (the land itself) will always have value. Though vacant land is generally not a preferred real estate investment because of the lack of steady cash flow, the land could offer its owner other benefits, such as the use of the land itself for hunting, fishing, or as a buffer for a residence or business.

Income-Producing Assets

When it comes to investor favorites, income-producing real estate is favored. An income-producing real estate asset is bought with an expectation that the asset will return dollars on that investment year over year and also hold its original value or even increase its original value. The “value” is calculated by dividing the yearly cash flow by a market capitalization rate, commonly known as cap rate. For example, $100 in cash flow divided by a market cap rate of 8% equals a value (or net worth or price) of $1250. The market cap rate will greatly swing the value of an asset. A Class “A” asset might bring a 5% cap rate (making the value/price $2000) and a Class “C” asset might bring a 12% cap rate (making the value/price $833). Each asset returns $100 but has a very different value. So, why is this? Basically, it comes down to risk. Class A will likely have a very steady income, require less capital improvements, and have a better chance to return the $100 year over year. Therefore, Class A requires much less risk to get back the $100 return. A Class C asset may be in a bad neighborhood, require continual capital upgrades, or have a short term lease. Therefore, the Class C asset requires much greater risk to return the $100 year over year. In the end, the investor must decide how much risk he or she is willing to take. The greater the risk, the greater the reward to accumulate wealth.

The scenarios described above are common examples of real estate investments; still, the world of real estate offers many more investment options to those interested in investing in assets they can see and touch. If you are curious about how you or your institution can capitalize on real estate investment opportunities, an experienced real estate financier will best be able to assist you in your endeavors.